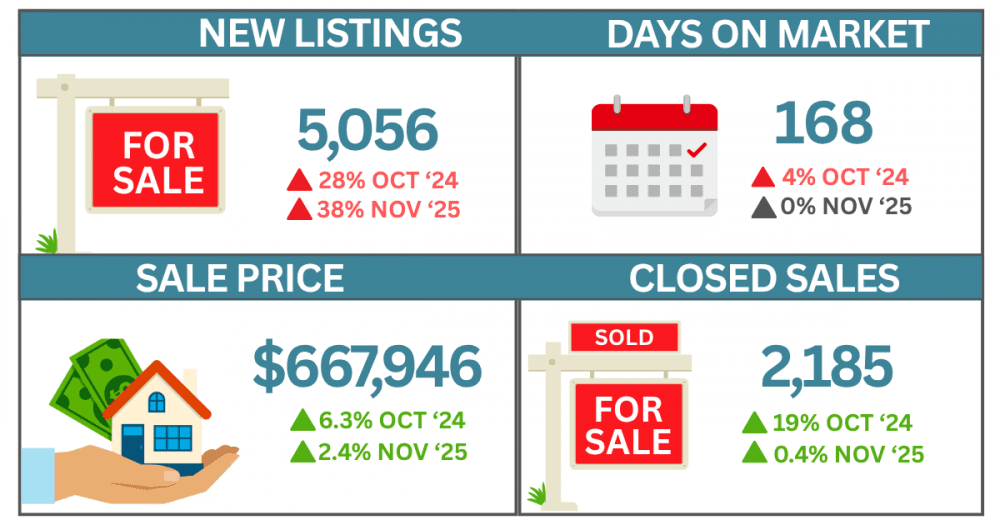

If you’ve been wondering whether it’s still a good time to buy or sell in Southwest Florida, the numbers might surprise you. The market has been heating up again, showing signs of renewed confidence from both buyers and sellers across Lee and Collier counties. Here is your November Southwest Florida Housing Market Update, brought to you by the SWFL Home Group.

Data Pulled from Naples Area Board of Realtors MLS

Data Pulled from Naples Area Board of Realtors MLS

A Market on the Move

From October 2024 to October 2025, the Southwest Florida housing market has shown steady strength and momentum.

📊 Year-over-Year Highlights:

-

Average Sale Price: Up 6.4%

-

Closed Sales: Up 22%

-

New Listings: Up 27.6%

-

Average Days on Market: Up 3.7%

After a quieter start to the year, activity surged through the summer and into fall. More new listings hit the market, giving buyers greater choice — yet demand has remained strong enough to push sale prices upward.

October Shows Fresh Energy

Month-over-month trends also show encouraging movement:

-

Average Sale Price climbed another 2.4% from September to October.

-

Closed Sales inched up slightly by 0.4%, while

-

New Listings jumped an impressive 39% — a clear signal that more sellers are re-entering the market.

-

Days on Market remained steady, suggesting that homes are still moving at a consistent pace.

What This Means for Buyers and Sellers

For sellers, this combination of higher prices and steady demand creates a strong opportunity — especially as more buyers aim to secure homes before potential interest-rate changes in early 2026.

For buyers, a growing inventory means more negotiating power and the chance to find homes that better match your wish list. Prices are rising, but still within range compared to many coastal markets, keeping Southwest Florida attractive for both primary and seasonal buyers.

Predictions: What Comes Next

Interest Rates & National Market Trends

Across the country, economists expect mortgage rates to gradually ease through 2026 — but not to the historic lows of past years. Most forecasts predict that 30-year fixed rates will stay in the mid-6% range through next year before dipping closer to the high-5s by the end of 2026.

Nationally, home sales remain slower than average as buyers adjust to these “new normal” borrowing costs. However, in lifestyle and relocation markets like Southwest Florida, strong population growth and continued demand for sunshine-state living are helping to stabilize prices.

What It Means for Southwest Florida

-

For Buyers: If you’ve been waiting for rates to drop dramatically, that may not happen anytime soon. With prices still rising and competition starting to return, buying sooner could mean avoiding higher prices later.

-

For Sellers: This could be your moment. As more inventory hits the market, competition among sellers will rise — so listing while demand remains solid may help you capture top dollar.

-

For the Market Overall: Expect 2026 to bring a more balanced market. More inventory and steady buyer demand should create healthier negotiations on both sides. Price growth is likely to continue, but at a more moderate pace compared to the sharp gains seen earlier this year.

The Bottom Line

The Southwest Florida housing market continues to show resilience, balance, and opportunity. With sales volume up, prices trending higher, and more homes hitting the market, confidence has clearly returned.

Want to see what your home could sell for in today’s market? Get an instant home value estimate and equity analysis!

To stay up to date on housing market trends, off-market listings, new business openings, upcoming local events, and more, subscribe to our 8-year-running newsletter!