Over the past few months, mortgage rates have increased significantly. In January of 2022, the average rate for a 30-year fixed mortgage was just 3.22%. Today, however, the average rate is 5.22%. To put that into perspective, this change would raise the payment on a $300,000 home by roughly $340 per month. For a large number of financed buyers, this has drastically lowered their buying power.

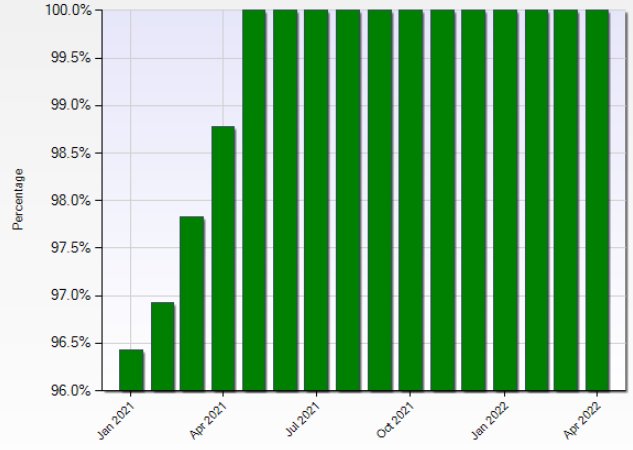

Despite this, here in Southwest Florida we’re going on month number 11 of the average sale price being AT LEAST 100% of asking price. (See figure 1 below.) This is primarily due to the large portion of cash buyers in our area. In March, out of 4,066 total closings, 2,158 were cash while only 1,841 were financed. Of the financed closings, 1,545 were conventional loans, while only 233 were FHA loans and just 63 were VA loans.

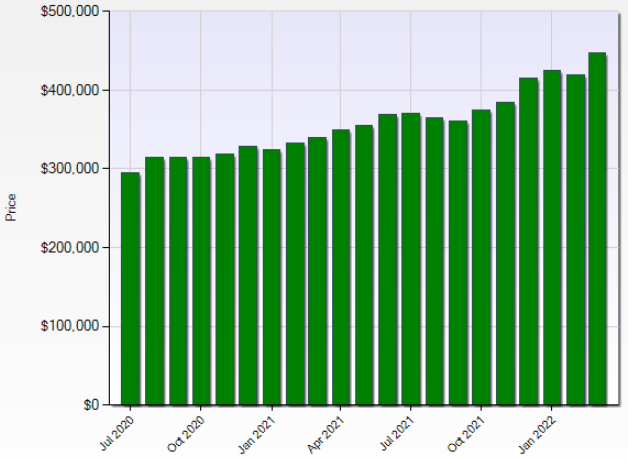

Sale Prices

In March, we “celebrated” another month of record sale prices for the area– a celebration that has occurred just about every month since July of 2020. (See figure 2 below.) In March of this year, the median sale price in Southwest Florida was $448,000, and April is on track to beat that.

Below is a breakdown by area of the median sale prices in March:

Bonita Springs: $510,000

Estero: $466,000

Naples: $581,000

Fort Myers: $345,000

Fort Myers Beach: $700,000

Lehigh Acres: $295,000

Cape Coral: $405,000

North Fort Myers: $242,500

Based on the available data, the Southwest Florida market is holding strong with no signs of slowdown or plummeting prices. The median number of days on market before accepting an offer is just 5. While we are seeing more price decreases lately, well-priced homes are still ‘flying off the shelves.’

Want to know what your home could sell for in today’s market? Give us a call anytime to schedule your Free Home Analysis, or check out our Instant Home Value Estimator below!

Home Value Estimate