The average sale price in Southwest Florida has risen nearly 30% since this time last year, and homes seem to be selling faster than new ones can be listed. All of this action in the market has some folks asking us, “is this a bubble?”

A bubble is an economic cycle that is characterized by the rapid escalation of market value, particularly in the price of assets. This fast inflation is followed by a quick decrease in value, or a contraction, that is sometimes referred to as a “crash” or a “bubble burst.” – Investopedia.com

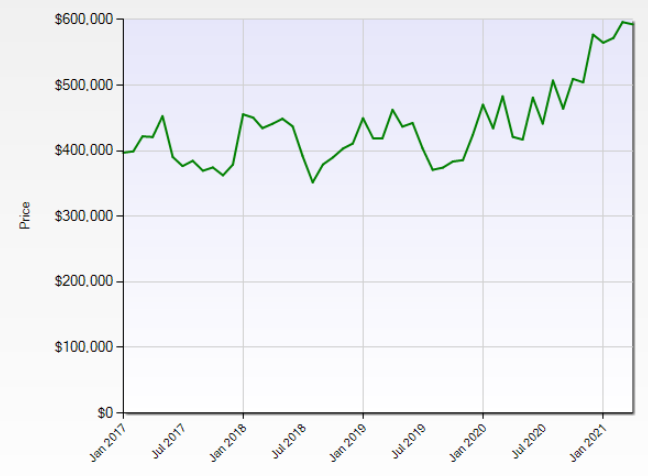

To answer this, we have to look at trends from past years. According to the graph below, Southwest Florida sees a sharp increase in average sale prices around January every year. These higher averages plateau until about July, and then we see a quick decline through the summer.

The beginning of 2020 followed the status-quo: increased average sale prices around January, followed by a decline in the summer. The “summer lull” did not last long, however.

Covid-19 caused an increase in real estate market activity. More people wanted to upgrade their homes within Southwest Florida, and more people wanted to move here from out of state. This effectively flung us into season-like market conditions in the late summer of 2020.

This upward trend in sale prices continued through to the beginning of 2021. In the past couple months, it finally began to plateau, just as it has done in past years.

Over the next few months, we’ll likely see the market ease up a bit as it historically does in the summer. While our average prices may be higher now, we seem to be following the same market patterns as previous years.

Another Note…

While Southwest Florida cities commonly rank among the fastest growing in the country, we somehow haven’t seen a significant increase in property values in the past 5-or-so years. I believe the circumstances caused by the Covid-19 pandemic essentially boosted us into a market correction, that, otherwise, may have taken several years to play out.