As 2018 comes to an end, we can begin looking ahead to what the new year may bring the housing market.

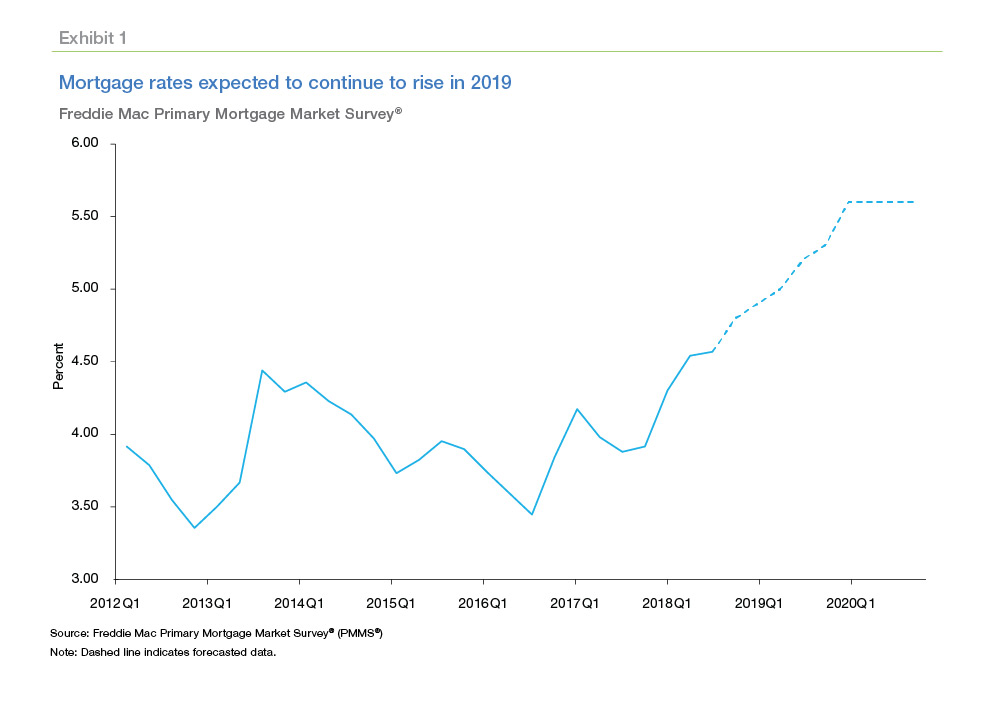

At the start of 2018, the 30-year fixed mortgage rate was around 4.1%. Currently, those rates are at 4.8%, and continue to climb. During one week in October, rates reached a staggering 4.94%, the highest they’ve gone since 2011.

As you can see from the above graph by Freddie Mac, rates are expected to average 5.1% in 2019. Some experts are saying that they will reach 6% by the end of 2019. While a number of factors play into forecasting mortgage rates, here are the most dominant:

Economic Growth

One of the single largest factors affecting mortgage rates, is the level of economic growth, such as gross domestic product (GDP) and the employment rate.

In 2018, GDP reached record highs and the unemployment rate reached record lows. This positive economic growth causes consumers to gain more financial confidence, leading to an increase in home sales. The subsequent increase in demand for housing causes lenders to raise their rates accordingly.

FED Monetary Policy (Money Supply)

In general, when the Federal Reserve tightens the money supply, mortgage rates are driven upward. Contrarily, when the FED loosens the money supply (a nice way of saying “printing trillions of new dollars”), rates are given downward pressure. It is expected that, in 2019, monetary policy will tighten, causing rates to continue their ascent.

Housing Market Conditions

When consumer’s financial confidence is up, and more homes are being bought, home builders are obligated to build more homes to keep up with the rise in demand.

With mortgage rates and home prices rising, builders have had to change their strategy to adjust for these increases. For this reason, we’ve seen a slight decrease in new, single-family home construction, and a large increase of new, multi-family home construction. The affordability of multi-family housing keeps consumers buying homes, and in return, causes mortgage rates to continue their upward trend.

Summary

Currently, both mortgage rates and home prices are rising. We’re expecting that, soon, home prices will begin to plateau (possibly even dip) to adjust for the increase in mortgage rates. Generally, the market is good at self-correcting to keep consumers doing what they do best: consuming.